The Inevitable Evolution of “Value-Add VCs”

Carl Fritjofsson, the founder of Creandum, recently published an insightful article on whether VCs add value for founders. Repeating their survey of a group of VC and founders from four years ago to see whether VCs really add value, Fritjofsson and his colleagues set out to see how much had changed since then. Through their findings, Fritjofsson and the Creandum team have done a solid job of unmasking perceptions regarding founder and VC relationships. Overall, their survey found that VCs overestimate their level of impact and helpfulness: founders rated the average impact of their VCs as a 5.2 whereas VCs rated their impact a decent 7.1 — a 35% difference.

Gaps in perceived impact

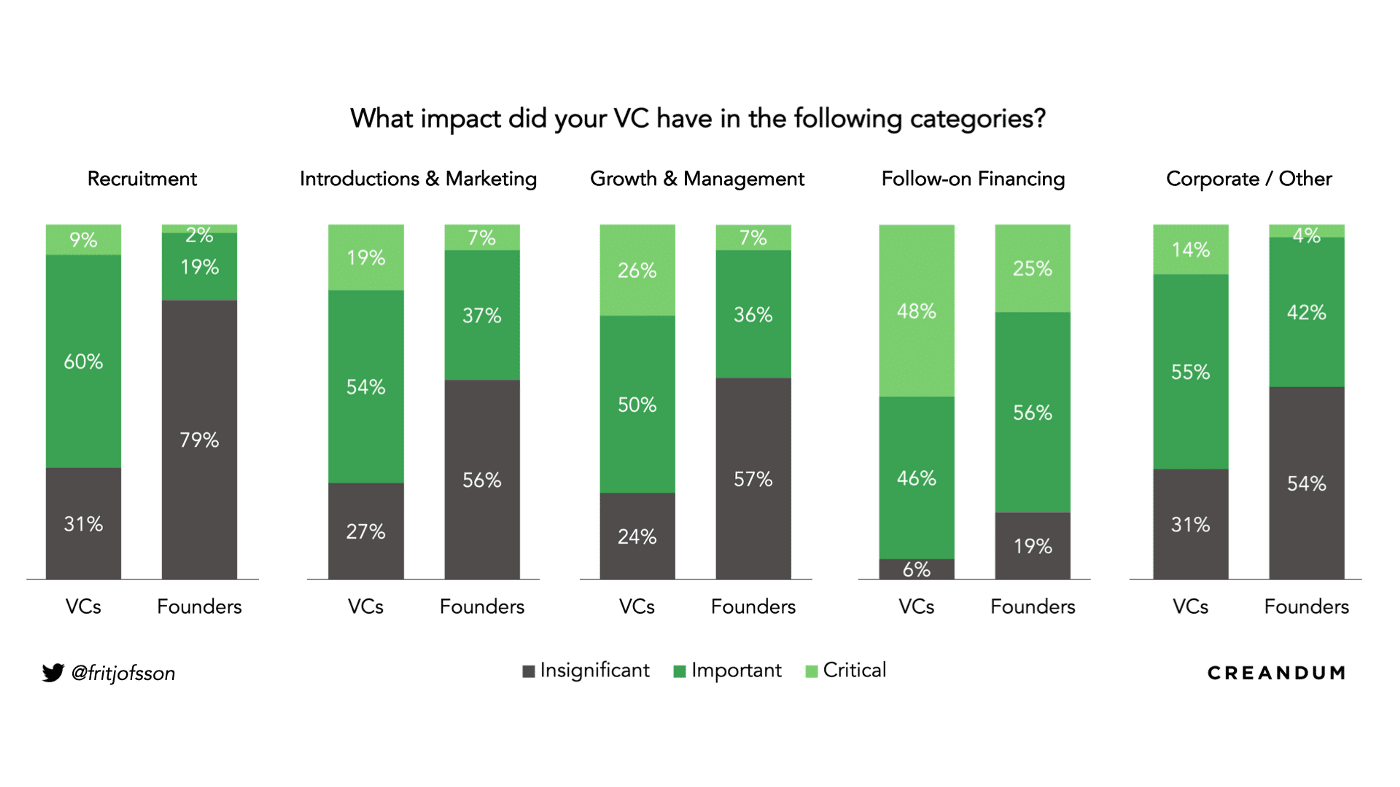

When they dove deeper, Fritjoffson and the team found that the largest gaps in perception between founders and VCs were in recruitment, introductions, and marketing. However, Fritjoffson notes that the perceived VC impact by founders can vary widely, ranging from critical in some areas to insignificant in others. His explanations behind this wide range are the quality of the VC and their relationship with founders as well as the natural cycles any founder-investor relationship follows. To make a larger impact, Fritjofsson proposes that VCs should go beyond simply allocating capital by leveraging their network for hiring, biz dev, fundraising, and more. In addition, when a company is smoothly sailing, they may not need help from their investor but during choppy waters, the company may need the VC to step in and help them navigate.

Investors with an impact

Overall, Fritjofsson and his colleagues have done a solid job unmasking founder / VC relationship perceptions. And while there may be plenty of upside for VCs, there are definitely investors out there consistently earning “job well dones” today. For example, I’ve had the privilege of seeing founder-operator VCs like Margaret Roth Falzon and Guy Filippelli roll up their sleeves and earn kudos from their portcos week in, week out across multiple business facets. Whether fine-tuning marketing or closing pipeline deals, there’s, without a question, a class of investors who’ve organized their funds to make an impact. In fact, Fritjofsson’s study found that the area both founders and VCs agree that VCs have a significant impact is on follow-on financing. Fritjofsson explains the power behind the punch, stating that VCs have multiple strategies to raise follow-on capital such as connecting founders with the right people and funds, supporting on preparation materials such as decks and financial plans, and helping craft fundraising strategies.

The future of founder-VC partnerships

Fritjofsson’s biggest takeaway from his research is that founders and VCs need to align on expectations at the start of their relationship. This is how founders can fully leverage their partnerships with VCs. Founders need to do their due diligence, finding VCs that can deeply understand the company offerings and seeking references to ensure expertise and trustworthiness. On the VC side, investors need to clearly communicate how they see the investment leveraged, their vision for the firm’s future, and the specific services they can offer. I suspect that if more founders had the opportunity to know what’s out there in the VC industry, it would raise the bar for the entire venture financing sector—or at least reset expectations. Despite mismatches in perceived impact, only 14% of founders surveyed by Fritjofsson had an experience that would make them not take a VC’s capital again. By considering the most important factors for founders when partnering with a VC—personal chemistry, sector experience, and speed—VCs can provide meaningful help in crucial operational areas of business. Bottom line, board partnerships are evolving, as they should, because of the measurable impact when advisors collaborate with startups and row the boat alongside founders.

Level Up with FinStrat Management

Ready to gain a competitive advantage as your firm grows and scales? Founded in January 2017 and based in Annapolis, Maryland, FinStrat Management provides venture capital firms with end-to-end back-office accounting and administration service solutions. Let’s get started with a free consultation today.