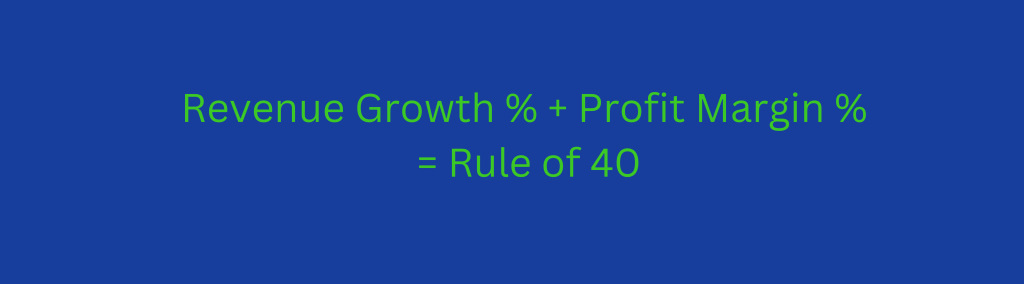

What is the SaaS Rule of 40?

The SaaS (Software-as-a-Service) Rule of 40 is a metric commonly used in the software industry to evaluate a SaaS business’s health. To do so, the SaaS Rule of 40 formula considers both revenue growth and the profit margin. Simply put, the Rule of 40 suggests that when adding the revenue growth rate and profit margin percentages, a number equal to or greater than 40 implies a healthy and sustainable SaaS business.

Where Did the SaaS Rule of 40 Come From?

The Rule of 40 became a popular and often discussed SaaS metric when venture capitalist and cofounder of Techstars,’ Brad Field, wrote a blog post on the topic. The story goes that while at a board meeting, he heard a late-stage software investor describe its “40% rule” for a healthy software company with at least $50 million in annual revenue. Brad’s opinion has been that a SaaS business can start to use the Rule of 40 metric when it has reached $1MM in Monthly Recurring Revenue (MRR).

Why is the Rule of 40 Important?

The Rule of 40 has become a valuable metric to measure and track the overall health of a SaaS business. In our opinion, three overarching reasons have contributed to why the Rule of 40 metrics has caught on in the SaaS metric world.

1. Overall Health Snapsho

Once a SaaS business has a product-market fit and reached $1MM in MRR, the Rule of 40 provides a valuable snapshot of whether a SaaS business has a healthy balance between revenue growth and profit. A combined number of less than 40 signals there may be an issue with either revenue growth, the profit margin, or both. However, the healthy balance between these two factors will vary depending on the lifecycle stage the SaaS business is in. At a high-level, these stages may include:

Rapid Revenue Growth Stage: The SaaS business is investing heavily in sales and marketing activities to drive revenue growth, primarily through the acquisition of new customers. As such, the revenue growth rate will contribute more to the Rule of 40, than the profit margin.

Balanced Revenue and Profit Margin Growth Stage: Once rapid growth has been achieved, more attention is given to finding a balance between revenue and profit margin.

During this stage, revenue growth activities will focus on both new and existing customers. With selling and marketing to existing customers more efficient at generating new revenue, also known as Expansion Revenue, the Profit Margin percentage should increase. Overall, this lifecycle stage will see a greater balance between revenue growth and profit margin percentage when calculating the Rule of 40.

Profit Margin Growth Stage: With a large customer base, greater efforts are now directed at making the firm more profitable. This may include reducing overhead costs, restructuring the organization, testing new revenue models, and exploring more opportunities to increase each customer’s lifetime value.

2. Easy for Investors to Understand

Investors in SaaS businesses may have a reasonable understanding of common financial statement metrics and even more SaaS-specific metrics. However, there seems to be a never-ending list of metrics to review, understand, and determine if a SaaS business is on the right track.

With a SaaS business in the rapid growth phase, the Rule of 40 will quickly inform an investor if the investment in rapid growth is generating adequate value if the revenue growth percentage is at or more than 40%. Conversely, if the SaaS business’s efforts have moved to make the business more profitable, is the resulting profit margin percentage adequately contributing to reaching 40% or above?

3. Benchmarking

SaaS businesses will decide whether to focus on revenue or profit growth depending on where in the lifecycle it currently is. In the early stages, it will typically focus on rapid growth, and shift to a profitability focus as they begin to mature. However, how do they know if the results of their focused efforts are generating results in line with their peers?

According to a 2017 Bain & Company study, 40% of 86 software companies studied outperformed the Rule of 40. Regardless of whether focusing on revenue or profit growth, the Rule of 40 provides a valuable benchmark to measure overall health of a SaaS business.

How to Calculate the Rule of 40

Calculating the Rule of 40 is, thankfully, fairly simple. This calculation only requires two inputs — the growth rate and the profit margin percentages.

When these two metrics are added together, the resulting percentage will help determine how healthy a particular SaaS company is by how close it is to 40. Let’s review how to calculate both the revenue growth rate and profit margin percentages.

Calculating Revenue Growth Rate and Profit Margin Percentages

Before calculating the Rule of 40, a SaaS business will need to determine its revenue growth rate and profit margin percentages. It’s important to ensure the same reporting period is used for both revenue growth and profit margin percentages.

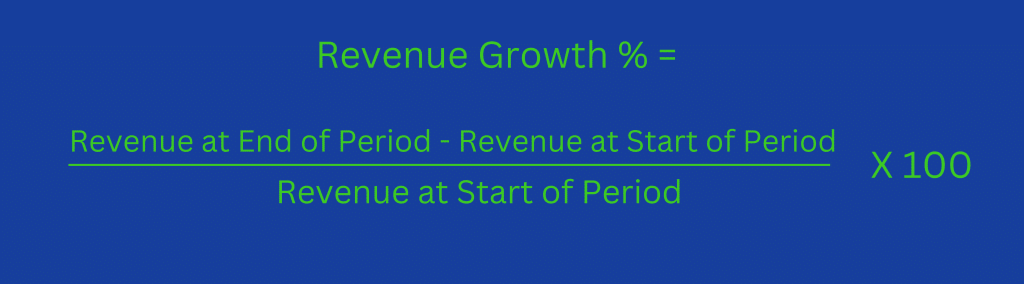

Calculating Revenue Growth Percentage

The growth rate can be calculated by taking the difference between the starting and ending values of a specific time period and dividing it by the starting value. That number can then be multiplied by 100 to get a percentage.

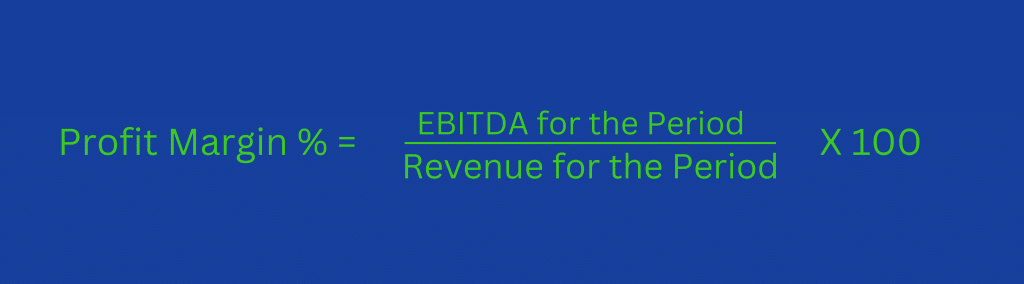

Calculating Profit Margin Percentage

The profit margin can typically be calculated by using the EBITDA (earnings before interest, taxes, depreciation, and amortization). The EBITDA margin is essentially a rough approximation of a SaaS company’s cash flow.

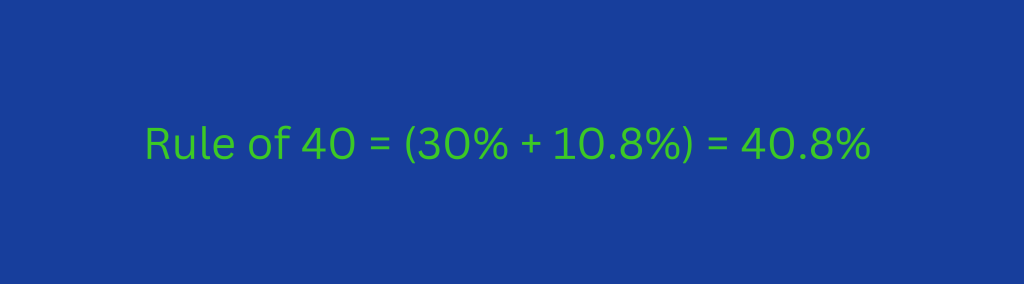

Rule of 40 Calculation Example

Let’s say a SaaS company has Recurring Revenue of $50MM in 2021, and $65MM in 2022. The revenue growth year-over-year would be 30% [($65-$50)/$50] x 100. The company had a profit (EBITDA) of $7.0MM in 2022, resulting in a Profit Margin percentage of 10.8% ($7/65) x 100. In this example, the company was able to get slightly above the Rule of 40 at 40.8%.

How to Achieve or Even Outperform the Rule of 40

A SaaS company’s Rule of 40 will generally fluctuate over time, which is common. If these fluctuations are trending down, it signals to the business that they need to improve one of the Rule of 40 inputs – the profit margin, revenue growth, or both. With that said, there are noteworthy activities B2B SaaS companies can focus on to stay competitive and keep as close to or above the Rule of 40; these include:

Focusing on Retaining Existing Customers

It is much easier and less expensive to keep existing customers than to bring in new ones. The customer acquisition costs (CAC) have already been incurred, and the direct costs of keeping existing customers are considerably less than those of new customers. While retaining existing customers won’t greatly impact revenue growth percentage, it has an ongoing positive impact on the profit margin percentage in the Rule of 40 calculation.

Supporting Engineering Teams to Increase Productivity

As SaaS companies continue to grow, engineering teams face an array of new challenges. These challenges include attempting to balance the demands of product maintenance with those of producing new features. To increase productivity in this department, technical employees should be properly supported with clear objectives and have the ability to provide feedback on what is and isn’t working to enable continual improvement to existing processes and the software product.

Sales and Marketing

Sales and marketing activities are critical throughout a SaaS business’s lifecycle. Even if a SaaS company has an excellent product market fit and can clearly provide value to its target market, it’s all for nothing if it can’t get prospective customers to know, like, and trust them. Sales and marketing activities need to be continually reviewed and refined through information gained through feedback loops. Making small adjustments over time can quickly dial in sales and marketing efforts and generate more revenue over time.

Frequently Asked Questions (FAQs)

What is the Rule of 40 SaaS gross margin?

The Rule of 40 doesn’t use gross margin to determine the profit to be used in the formula. Rather, it typically calculates the profit margin percentage EBITDA over Revenue for a specific period.

Does the Rule of 40 only apply to SaaS?

Yes. The Rule of 40 should only be used for subscription-based software companies (otherwise known as SaaS companies). SaaS businesses have a unique business model, and the Rule of 40 is geared toward this industry.

What is the Rule of 40 in Salesforce?

The Rule of 40 can be used by SaaS companies (like Salesforce) to measure profitability and growth potential by adding together the revenue growth rate and profit margin percentages.

Salesforce’s Rule of 40 over the past twelve months came out to 38.5%, which is lower than the company’s average Rule of 40 (44.8%). Salesforce’s Rule of 40 peaked in January 2020 at 50.3% and hit its 5-year low (38.5%) in January 2023. In 2021 and 2023, Salesforce’s Rule of 40 decreased by 13.4% and 13.7%, respectively, while it increased by 2.8%, 6.8%, and 2.4% in 2019, 2020, and 2022 (respectively).

Where did the rule of 40 come from?

Interestingly, the Rule of 40 can be traced back to a venture capitalist named Brad Field. Apparently, Brad was at a board meeting in 2015, where a late-stage investor introduced him to the concept of the Rule of 40. While Brad did create the Rule of 40, or the “40% rule” he first heard at the board meeting, he is credited with introducing the Rule of 40 to the SaaS word.

When to Use the Rule of 40

Brad Field, who introduced the Rule of 40 to the SaaS industry, suggests that companies with monthly recurring revenue (MRR) of at least $1 million can also start to use the Rule of 40. However, there isn’t necessarily a “right time” for a SaaS company to use the Rule of 40.

If you found this article informative here are three more you won’t want to miss:

Calculating Annual Recurring Revenue

Guide to Revenue Recognition

Cash Adjusted EBITDA

Contact us to learn about our financial services for B2B SaaS companies.