Calculating Your Cash Burn Rate

The world of finance can be overwhelming for any business, including those in the Software as a Service (SaaS) industry. One important financial concept to understand and consider when making important business decisions is the cash burn rate. Calculating the cash burn rate is essentially the sum of all business expenses, including what goes into sales and marketing, and overhead costs. If a SaaS company isn’t bringing in any revenue to offset operating expenses, the company is basically “burning through” all of its funding.

There are two types of burn rates SaaS business owners should keep in mind, namely gross burn rate and net burn rate. To put it simply, gross burn rate is the sum of all operating expenses, while net burn rate is a SaaS company’s total revenue minus the gross burn rate. Some companies might initially neglect to cover all of their expenses, especially as sales pick up. This could end up resulting in a negative net burn rate, which means a company in this situation would need additional funding.

As the company grows, it will eventually reach a break-even point and start generating positive cash flow — though SaaS business owners should keep in mind that it may take some time to get to this point. This is a common position for software startups to find themselves in, especially in the early stages of selling. If SaaS entrepreneurs can learn how to calculate their company’s cash burn rate, however, they may be able to make more informed decisions and gain a little more control over their company’s finances.

What is Cash Burn Rate?

In short, a SaaS company’s cash burn rate serves as a measure of the startup’s overall financial health. For startups that follow a SaaS model, burn rate is a critical metric, as it measures the amount of money that the company spends on operating expenses in a given amount of time. Because startups initially use cash reserves and haven’t generated any revenue yet, they tend to end up with negative cash flow due to their spending.

As previously stated, two types of burn rates exist: gross burn rate and net burn rate. To reiterate, while gross burn rate represents the cash that a startup needs to survive over one month (this is also known as the monthly burn rate), the net burn rate is what’s left over after the gross burn is subtracted from the startup’s total revenue. If a startup doesn’t have any revenue (yet), the gross and net burn rates may be equal. Detailed below are a few relevant scenarios:

Scenario #1

A SaaS company reaches the break-even point (i.e. its total revenue is equal to its gross burn rate). Initially, there wasn’t any market need for their software, so they ended up generating a negative cash flow. Over time, though, customers started using the product, so the startup was able to create a positive cash flow.

Scenario #2

A SaaS company’s total revenue surpasses its gross burn rate, and this results in a positive financial outcome for the startup. This company was successfully able to earn more than it spends, which was widely due to the market demand for its software, as well as its efficient operations and cost management. This is the point that most startups want to get to, though it’s common for startup owners to get frustrated since this type of growth takes time.

Scenario #3

A SaaS company’s total revenue ends up being less than its gross burn rate, which is typically what happens to startups during the first stages of product development. This makes sense, because the startup has not even started selling to customers yet. In this scenario, the company will need to keep this developmental stage as short as possible, since it won’t be able to rely on outside funding forever.

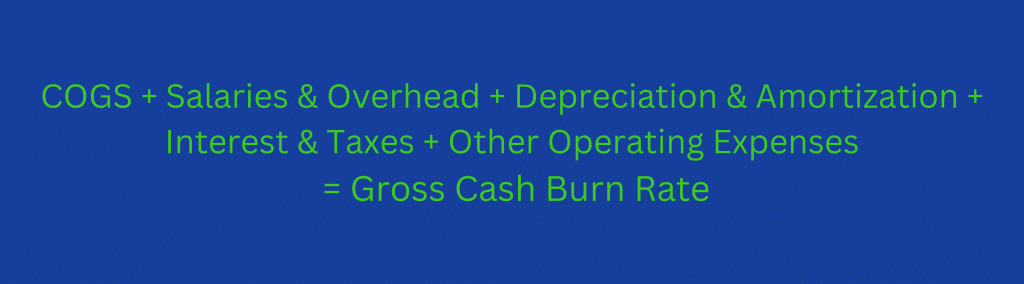

How to Calculate Gross Cash Burn Rate

The gross cash burn rate formula can be used to calculate the total amount of cash spent on monthly operating expenses within a SaaS business. This formula includes cost components like COGS, salaries and overhead, depreciation and amortization, interest and taxes, and other operating expenses. The gross cash burn rate formula looks like this:

COGS

Each of these components is important, but a few of them may be difficult for new SaaS business owners to understand. COGS (Cost of Goods Sold), one of the main components of the gross cash burn rate, tends to include any expenses that are related to providing support, computer equipment depreciation, website development activities, cloud services, data security, and data center capacity.

Salaries and Overhead

Salaries are also a crucial component to include in the gross cash burn rate formula. This, of course, refers to payroll expenses for employees who are involved in the research and development of both new and existing products. This component may also include the salaries of employees who are responsible for website or app development, infrastructure costs, and product displays in online stores.

Depreciation and Amortization

The third component of this calculation, depreciation and amortization, typically includes infrastructure costs (i.e. networking equipment, servers, and data center-related depreciation and amortization. Rent, utilities, and any other expenses that are related to SaaS providers and the SaaS business as a whole may be included in this component as well. These expenses basically reflect a SaaS business’s investments, which can make a big difference when it comes to serving customers and offering top-notch products.

Interest and Taxes

Interest costs tend to come up when a SaaS business borrows funds to support business activities — like financing software development or acquiring new infrastructure and hardware. Taxes usually include corporate income taxes, payroll taxes, and sales taxes. It’s crucial that SaaS business owners include this component in their calculation when determining their company’s gross cash burn rate.

Other Operating Expenses

This component mainly includes things like day-to-day operating expenses, marketing expenses (i.e. advertising and public relations costs), and legal fees. Office supplies and travel expenses may also be included under other operating expenses. SaaS business owners will need to track these expenses carefully, as they’re just as important as payroll expenses, cloud computing costs, and computer equipment depreciation costs.

How to Calculate Net Cash Burn Rate

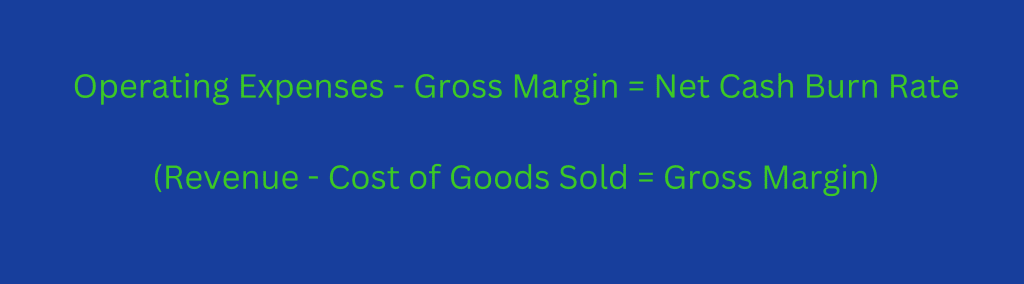

The net cash burn rate (also known as “burn rate”) can be used to describe the rate at which a SaaS business “burns” through its cash reserves. These cash reserves are typically used for operating expenses, and most companies tend to burn through them pretty quickly. The net burn rate calculation is as follows: All expenses must be subtracted from the cash received within one month. As previously stated, an SaaS business has a positive net burn rate when its monthly operating expenses surpass its total revenues. The net cash burn rate formula looks like this:

The net cash burn rate effectively demonstrates how much negative monthly cash flow a SaaS business experiences. It essentially lets a SaaS business know how much cash it needs each month in order to continue operating without making a profit. In other words, the burn rate quantifies the amount of cash that a company burns in order to generate additional annual recurring revenue (ARR).

A SaaS company with a high burn rate is likely using too much cash to achieve growth, whereas a company with a low burn rate may be doing a better job of striking a healthy balance between growth and profitability. Startups with a SaaS model should ideally try to aim for this balance, as it can help maintain sustainability in regard to cash flow and profit.

How to Improve Cash Burn Rate

How can a startup improve its cash burn rate over time? There are several ways that a SaaS business can go about doing this. For example, it can consider reducing its expenses. This may include removing expenses that don’t actually impact business operations. To determine what expenses need to be cut or reduced, a SaaS business can review its financial statements and take whatever actions seem necessary (i.e. hiring staff on a contractual basis, outsourced accounting, or negotiating a rent-deferred payment plan).

A SaaS business will also need to take its increasing cash reserves into account, as these cash reserves tend to come in handy during especially lean periods. Businesses may want to liquidate any unused assets or clear out obsolete raw materials to increase cash reserves. It may also be a good idea to seek out external investors or explore what the government has to offer in terms of grants or subsidies. A SaaS startup should ideally have a contingency plan in place so that it can increase its cash balances.

Another way that a SaaS business can improve its burn rate is by delaying payments until a future date. Some businesses may want to shift to interest-only loans, or ask suppliers whether or not they can make partial payments (or make complete payments at a later date). Contacting the IRS and asking about deferring tax payments is another option for SaaS businesses to consider.

In desperate times, a SaaS business may also want to figure out alternative sources of revenue in order to alleviate its financial crisis. This can be accomplished by finding new customer segments, or coming up with additional services in order to attract more customers. It often takes quite a while for a SaaS business to achieve an ideal cash burn rate, so patience is definitely a virtue in this case.

As long as a SaaS startup is willing to put the time and effort in, achieving a good cash burn rate shouldn’t be too much of an issue. This tends to be especially true if there is a high market demand for the product that the SaaS company is selling. SaaS business owners must be thoughtful and vigilant when it comes to using their cash reserves, because, once again, these reserves can be quite easy to burn through.

Frequently Asked Questions

What is a good cash burn rate?

As a general rule of thumb, a startup should have around six to twelve months’ worth of expenses in their bank account. This is essentially a safety net that ensures that the startup will have enough cash to sustain its operations in case of an emergency or any other unforeseen circumstances. For example, let’s say a new e-commerce startup has $50,000 in its bank account. A good burn rate for this startup would be between $4,167 (12 months’ worth of expenses) and $8,333 (6 months’ worth of expenses). Ideally, the startup in this scenario would refrain from spending more than $8,333 each month on operating expenses.

How is cash burn rate calculated in SaaS?

A SaaS business’s cash burn rate can be calculated by subtracting the company’s total expenses from its total revenue. The resulting figure can then be divided by the number of months in the specific period being measured. Once again, a positive cash burn rate indicates that the company is spending more money than it’s generating in revenue, while a negative cash burn rate is an indication that the company is generating a positive cash flow and, therefore, doesn’t have to rely on outside funding.

Where can I find the cash burn rate?

Finding the cash burn rate is a fairly straightforward process. All that a SaaS entrepreneur or investor has to do is compare a SaaS company’s monthly bank account statements against its monthly financial statements — which tend to include the balance sheet, the income statement, and the cash flow statement. By using this method, SaaS business owners can easily determine how much cash they’re burning through every month, as well as whether or not they’ll have enough cash reserves to sustain the business over a long period of time. Calculating a SaaS business’s cash burn rate can also be a great way for investors to assess how financially viable the company actually is.

If you enjoyed this article here are three more you might want to read next:

Exploring Average SaaS Cost of Service

Essential Liquidity Ratios and Metrics

G&A Expenses and Why They Matter