CAC Payback Period vs. CLTV/CAC

Understanding and measuring sales efficiency is critical to a new or established SaaS business’s short-term and long-term success. However, in addition to the CAC payback period there are several sales efficiency metrics that, while similar, tell SaaS founders and leaders different things.

For example, Customer Acquisition Costs (CAC) Payback Period provides insight into how long it will take a SaaS business to recover its sales and marketing expenses incurred acquiring each new customer. Customer Lifetime Value (CLTV)/Customer Acquisition Costs (CAC), on the other hand, provides insight into how much revenue will be generated over a SaaS customer’s lifetime compared to its acquisition cost. So, which metric should a SaaS company focus on? Well, it depends on a few notable considerations.

In this article, we will review how to calculate CAC Payback Period, CLTV,

CAC Payback Period: The Basics

The CAC Payback Period tracks how long it takes for a business to make back its sales and marketing expenses from the revenue earned from obtaining each new customer. This metric helps organizations consider and weigh their sales and marketing plans wisely when allocating their resources. To determine this metric, businesses must first determine the CAC using the formula below.

Step #1 – Customer Acquisition Costs (CAC)

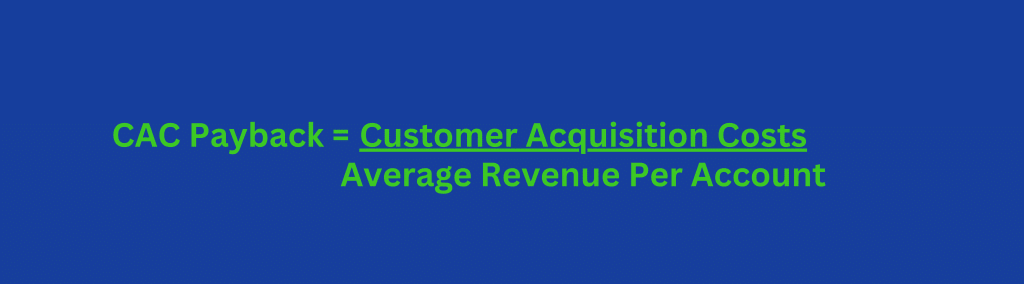

The next step to calculate the CAC Payback Period is to determine the average revenue per accounting using the formula below.

Step #2 – Average Revenue per Account (ARPA)

With the CAC and the ARPA calculated, the CAC Payback Period can be calculated using the formula below.

Step #3 – CAC Payback Period

CLTV/CAC Ratio

The CLTV/CAC Ratio is an essential measure that assesses the relationship between a customer’s lifetime value and acquisition costs. If this ratio is high, it indicates that customers are being acquired at a low cost in comparison to the revenue generated. This metric provides greater insight into ROI than simply looking at CAC Payback Period alone. This is especially for SaaS companies who need help assessing how efficient their efforts are in acquiring new customers so they can make informed decisions about budget allocation.

Comparing CAC Payback Period and CLTV/CAC Ratio

The CAC Payback Period is a critical metric for early-stage SaaS startups. Knowing how quickly they can expect their investments in customer acquisition costs (CAC) to be recovered will help them maintain cash flow and continue to fuel growth. For established companies, on the other hand, it’s important that attention shifts towards metrics like CLTV/CAC Ratio, which offers insight into the long-term profitability of marketing and sales strategies by considering the sustainability of those efforts.

Early-stage SaaS Startups

For early-stage SaaS startups, the CAC Payback Period should be the main focus to ensure they are getting a return on investment efficiently. The metric helps startups evaluate their immediate financial health, with a shorter payback period reflecting an efficient customer acquisition process, while longer periods may show that marketing efforts are not as effective.

Established SaaS Companies

Established SaaS companies should aim to focus and optimize their CLTV/CAC ratio as this is more relevant when evaluating if strategies regarding acquiring customers are sustainable over time. Higher ratios point toward acquiring customers at lower costs and generating more revenue, thus having a profitable business growth model. Optimizing this ratio ensures businesses use their resources wisely while obtaining maximum returns from marketing investments made.

On the other hand, the CLTV/CAC Ratio offers insight into overall business sustainability. By focusing on such a ratio, organizations can ensure that they invest wisely when it comes to gaining customers over time so as to increase its success rate long-term.

Strategies to Optimize CAC Payback Period and CLTV/CAC Ratio

By focusing on CAC Payback Period and CLTV/CAC Ratio, SaaS businesses can see a profitable business model and greater success. By leveraging customer segmentation as well as utilizing data-driven insights to optimize resource allocation, they will reduce their Customer Acquisition Costs while increasing the value of each consumer.

Reducing Customer Acquisition Costs

By optimizing marketing and sales campaigns, using customer segmentation, and harnessing data-driven insights, companies can reduce their Customer Acquisition Costs (CAC) significantly. Targeted advertising, such as retargeting campaigns or personalizing ads, can be a helpful approach in reaching higher-value customers, which will also lead to an improved Payback Period for CAC.

Increasing Customer Lifetime Value

Developing customer loyalty, maximizing sales for existing customers and cross-selling are all tactics that can be employed to raise Customer Lifetime Value. By encouraging repeat purchases with special offers or personalized experiences, businesses will maintain a strong connection with their consumers resulting in a higher lifetime value of the company/customer ratio (CLTV/CAC). To make these strategies more successful, companies can look at implementing discounts and rewards systems and establish an effective loyalty program that encourages continued engagement from its current customers.

Summary

Businesses can maximize their return on marketing investments by focusing on reducing customer acquisition costs, increasing customer lifetime value, and optimizing the CAC Payback Period and CLTV/CAC Ratio. By utilizing targeted strategies that improve retention rates along with data-driven insights, these critical metrics will contribute to sustained success for businesses in the long term.

We offer a variety of financial services for B2B SaaS businesses. Get in touch to learn more.

Frequently Asked Questions

What is the CAC payback period?

For most startups, the customer acquisition costs payback period tends to be short and often lasts no longer than twelve months. Conversely, successful SaaS enterprises can typically achieve a return on investment within 5-7 months of their initial cost acquisition (CAC). For large corporations with more capital available to them, recouping costs may take longer.

What is the difference between CAC and CAC payback?

Tracking Customer Acquisition Cost (CAC) is essential for businesses as it provides insight into the cost of bringing in new customers and the return generated from their marketing investments. CAC Payback is a metric used to calculate how long it takes to recuperate expenses related to customer acquisition costs. Businesses can use this information to formulate more effective strategies when allocating resources toward acquiring customers or advertising campaigns.

How to compare CAC and CLTV?

The CLTV: CAC ratio is a good indicator of profitability and can be calculated by dividing an average customer lifetime value by the customer acquisition cost. This number reflects how much return you are getting from every dollar spent to acquire new customers. Customer Lifetime Value (CLTV) along with Customer Acquisition Cost (CAC) must both be taken into account when analyzing profit margins and future investments in marketing strategies.

What is the problem with CLTV CAC?

It is necessary to ensure that the information used in calculating LTV:CAC is precise and current. Otherwise, any conclusions drawn from this ratio could be questionable. It’s essential to confirm both of the values being compared are correct. If either input value isn’t accurate, then all results generated by this metric may not be trustworthy.

What is the main difference between CAC Payback Period and CLTV/CAC Ratio?

The Customer Acquisition Cost Payback Period measures the time it takes to recoup acquisition costs, while CLTV/CAC Ratio compares customer lifetime value to those same acquisition costs.

Here are three more SaaS articles you might find helpful:

How to Calculate your CAC Payback Period

Increasing SaaS Revenue Per Account

What Exactly Is Annual Contract Value?

.