Annual Contract Value: What is it and How to Calculate

In today’s competitive SaaS landscape, understanding and optimizing the SaaS Annual Contract Value (ACV) can provide value. A well-executed ACV strategy can provide invaluable insights into a SaaS business’s performance, such as sales efficiency, that can help drive growth. This article will review what the Annual Contract Value is, its importance, how to calculate it, and how best to use it effectively.

Understanding SaaS Annual Contract Value (ACV)

The Annual Contract Value (ACV), also known as ACV bookings, quantifies the yearly value generated from a single customer contract. The average ACV metric also provides an overall understanding of the total revenue earned across all contracts on an annualized basis.

How to Calculate ACV in SaaS

SaaS businesses can calculate ACV in several ways. ACV can be calculated at the enterprise level, an average across contracts, or at the individual contract level. At the enterprise level, the average ACV can be calculated by taking the total contract value for all customers, and then dividing by the total length of all contracts.

It’s important to note that there seems to be disagreement on how to derive annual contract value – specifically, should it include one-time revenue items like onboarding or set-up fees. Our belief and assumption for this article is that one-time fees should be included. This is because including these one-time fees provides valuable insights into the total revenue generated that the similar SaaS metric, Annual Recurring Revenue (ARR), does not.

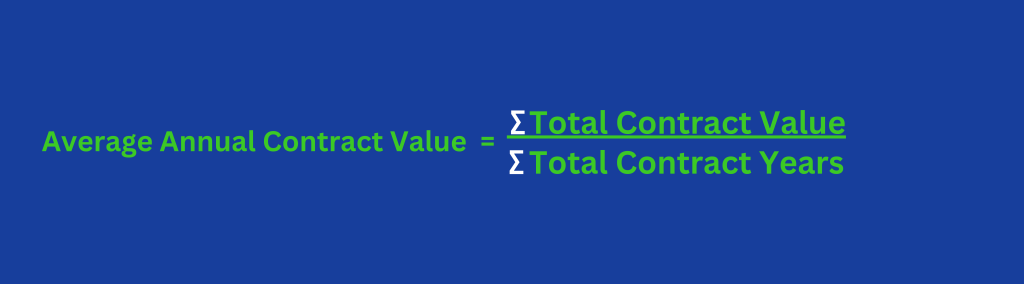

Average Annual Contract Value Formula

Average Annual Contract Value Example Calculation #1

If a SaaS business has ten 2-year contracts, and the value of each contract is $12,000, its Average Annual Contract Value is $6,000 ((10*$12,000)/(10*2)).

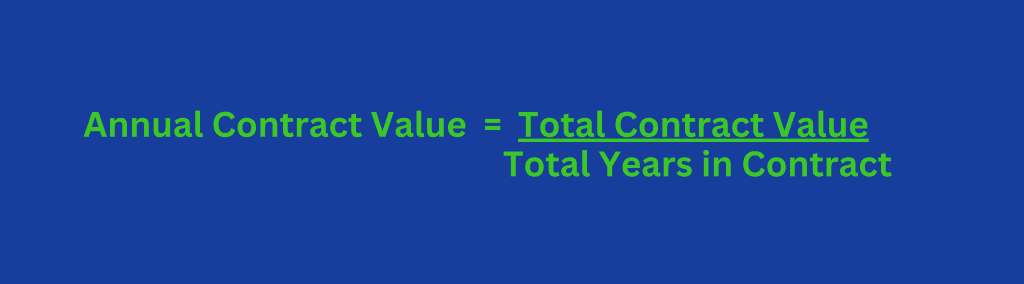

Individual Annual Contract Value Formula

Individual Annual Contract Value Example Calculation #2

To calculate the Annual Contract Value (ACV) of a 3-year contract valued at $80,000, we simply divide that total by three years to result in an ACV of $26,667 ($80,000/3).

With the average ACV across all contracts and individual contract ACV, companies have access to reliable data to use as a basis for financial planning and forecasting. For example, a SaaS company forecasting revenue for the next two fiscal years can take the average ACV as the base planning assumption and layer on further planning assumptions such as planned client growth projections and planned subscription price changes.

Comparing ACV to Other Key SaaS Metrics

It is beneficial to view ACV in relation to other important SaaS metrics such as ARR (Annual Recurring Revenue), CAC (Customer Acquisition Cost), and CLTV (Customer Lifetime Value). Examining the distinctions and links between these essential SaaS metrics may help uncover a more complete understanding of SaaS business’s performance, ultimately informing decisions related to efficiency gains or increased sales ROI.

ACV vs. ARR (Annual Recurring Revenue)

When evaluating the success of a SaaS business, two metrics – ACV and ARR – are often taken into account. While both focus on customer contracts and revenue streams, they offer different perspectives for assessing performance. For instance, Annual Recurring Revenue (ARR) provides an overall snapshot by tracking yearly recurring revenue without taking one-time fees or duration into consideration. Average Contract Value (ACV), digs deeper to determine how much each agreement is worth, enabling organizations to adjust their pricing or other strategies accordingly.

ACV vs. CAC (Customer Acquisition Cost)

The comparison of ACV to CAC is essential in gauging the efficiency and profitability of any SaaS business. This analysis looks at two main metrics: The Cost of Acquisition (CAC), which details how much it costs to gain new customers, and the Average Contract Value (ACV), which provides an annualized value per customer agreement.

By examining the relationship between both SaaS metrics, organizations can better understand whether their customer acquisition tactics have been successful enough to recover their investments in CAC – helping to make better decisions regarding marketing and sales strategies.

ACV vs. CLTV (Customer Lifetime Value)

ACV looks at the revenue generated on an annual basis, whereas CLTV focuses on predicting how much profit they will generate over their lifetime as part of that business relationship. Comparing these two metrics allows organizations to make informed decisions about maximizing income from clients.

Strategies for Optimizing ACV in SaaS Businesses

To increase ACV, SaaS businesses may devise and execute a sales and marketing plan that may include flexible pricing plans, focusing on higher value clients, and offering more subscription upgrades and premium options.

Let’s explore these strategies to get a better understanding of how they can help firms improve their Average Contract Value (ACV).

Pricing Strategies and Tiers

SaaS businesses can use pricing strategies and tiered plans to widen their customer base, thereby increasing Average Customer Value (ACV). These pricing tiers offer various levels of services at different prices, enabling companies to cater to a broader audience. ACV can be optimized by giving customers multiple options when it comes to price with features that meet individual needs and budgets.

Strategic changes in the price structure also present opportunities for optimizing ACV results. Companies need to analyze consumer behavior and market trends and craft special deals or subscription plans, such as team bundles or enterprise offers across organizations.

Targeting High-Value Customer Segments

Focusing on the high-value customer segments can benefit SaaS businesses in boosting their ACV, as these customers are more likely to invest heavily in the SaaS business’s subscription products. Leveraging various data points like purchase history, demographics, and usage patterns, it is possible to effectively segment these more valuable customers. Subsequently, marketers can tailor marketing and sales strategies to attract higher-value customer segments.

Besides that, various pricing plans could be set up to better serve those high-value clients’ needs, including subscription or tiered options along with adapting usage-based approaches if needed (something like offering deals based on actual utilization instead of predicted use volume, etc.).

Leveraging Upsell Opportunities

Maximizing the value of an existing customer base can be done by leveraging upsell opportunities in order to increase ACV. Offering discounts, bundling products, and providing additional services are all strategies that can be used to boost ACV.

Timing is also crucial when considering upselling since memories, milestones, or accomplishments from their past experiences should all be considered before approaching a potential upsell opportunity.

Summary

ACV is a SaaS metric that is often overlooked or incorrectly used interchangeably with ARR; however, it provides SaaS businesses valuable insights and helps drive overall revenue growth. SaaS accounting strategies such as implementing pricing plans, targeting high-value customer segments, and taking advantage of upsell opportunities are all strategies to increase ACV, which will contribute to the overall profitability of a SaaS business. Similar to other SaaS metrics, the ACV insight value is enhanced when used and compared to other SaaS metrics such as ARR and CLTV.

Frequently Asked Questions

What is the annual contract value in SaaS?

Annual Contract Value (ACV) is an important metric used to measure the dollar value of ongoing customer contracts in SaaS businesses averaged and normalized over one year. It considers the revenue generated from either a single customer contract or across contracts on an annualized basis.

What is an average contract value?

Average Contract Value, is a metric used in the SaaS industry that seeks to understand the average worth of customer contracts typically over one year.

What are some strategies for optimizing ACV in SaaS businesses?

For SaaS businesses to optimize their Annual Customer Value, there are several strategies that can be utilized. Implementing pricing plans and targeting high-value customer segments will help the business focus its marketing efforts while taking advantage of upsell opportunities will also increase the average customer value. Overall, by using these methods it is possible to effectively maximize ACV in a SaaS environment.

If you found this article valuable here are three more you might like:

Increasing Revenue Per Account

Your SaaS Renewal Rate

Calculating Gross Dollar Retention