How to Calculate Gross Dollar Retention

Recurring revenue is king in the Software as a Service (SaaS) industry and its important to understand and measure recurring revenue using metrics like Gross Dollar Retention (GDR).

At its core, GDR measures the revenue retained from existing customers over a specified period without considering any upsells or expansion revenue. This metric is indispensable for SaaS companies as it gauges customer satisfaction and product value by demonstrating whether existing customers continue to find value in your product, hence choosing to renew their contracts.

GDR is essential in understanding how well a company maintains its revenue base and identifying potential revenue leakage. SaaS businesses must strive to understand and improve their GDR in a highly competitive market, where acquiring new customers can be five times more expensive than retaining existing ones. This article will provide a comprehensive guide on calculating and interpreting GDR.

Understanding Retention Metrics in SaaS

In financial accounting for SaaS (Software as a Service) businesses, understanding customer retention metrics is important to assess the business’s overall health and long-term sustainability. Overall, there are four main retention metrics that businesses should familiarize themselves with: Gross Dollar Retention (GDR), Net Dollar Retention (NDR), Gross Revenue Retention (GRR), and Net Revenue Retention (NRR).

As previously explained, Gross Dollar Retention (GDR) measures the revenue retained from existing customers over a specified period without accounting for upsells or expansion revenue. It represents the company’s ability to retain revenue from existing customers, assuming no additional sales or upgrades.

Net Dollar Retention (NDR) is a similar metric, but unlike GDR, it considers upsells and expansion revenue. Essentially, NDR tells you how much your existing customers spend relative to a previous period, including any additional purchases or expansions. A higher NDR means your existing customers spend more over time, indicating a successful upselling strategy and high customer satisfaction.

Gross Revenue Retention (GRR) measures the percentage of retained revenue from a defined group of customers over a given period. It includes contractions but excludes churn, which allows for an understanding of how much revenue you can retain from existing customers before considering lost customers.

Net Revenue Retention (NRR) measures the change in recurring revenue from existing customers, factoring in upsells, churn, and contraction. It is a comprehensive metric that provides insight into customer growth or loss over time, playing a crucial role in understanding the company’s overall health.

These retention metrics are particularly important in recurring revenue business models like SaaS because they directly reflect customer satisfaction and the perceived value of the product or service. They clearly indicate whether the customers find ongoing value in the product and decide to continue or expand their usage. Maintaining high retention rates is paramount in a business model where customer lifetime value (CLTV) and recurring revenue are the keys to profitability and growth. Therefore, understanding these retention metrics, especially Gross Dollar Retention, is integral to running a successful SaaS business.

How to Calculate Gross Dollar Retention

Calculating Gross Dollar Retention (GDR) involves a simple yet informative formula. It provides essential insights into how much revenue your business retains from existing customers over a set period. Here is a step-by-step guide on how to calculate it:

- Identify Your Cohort: The first step in calculating GDR is identifying your cohort or the group of customers that you want to examine. Typically, the cohort is defined as the group of customers that started at the beginning of a specific period, such as a quarter or year.

- Calculate Initial Revenue: The next step is to calculate the total revenue from the cohort at the beginning of the period. This could include Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), or any other metric relevant to your business model.

- Calculate Ending Revenue: At the end of the period, calculate the total revenue from the same cohort. Importantly, this calculation should exclude any revenue from upselling or expansion. We are only interested in the revenue that was retained from the original product or service purchased.

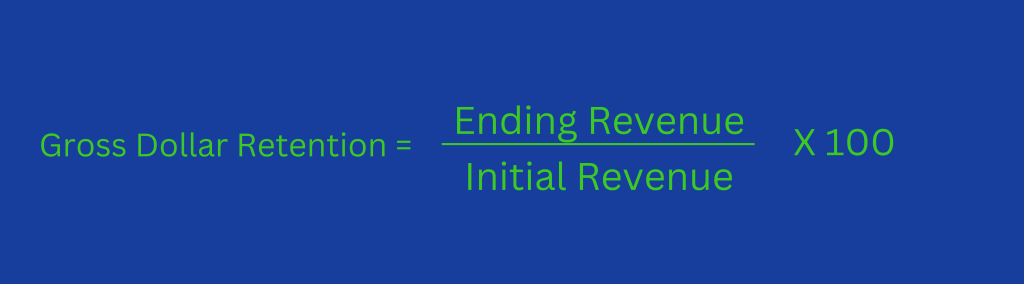

- Apply the GDR Formula: Once you have the initial and ending revenue, you can calculate GDR using the following formula:

This formula gives you the GDR as a percentage. A GDR of 100% means that you have retained all revenue from the cohort. Above 100% suggest your retained revenue has grown, indicating upselling or cross-selling, which ideally should not be the case for a correct GDR calculation. A GDR of less than 100% means you lost some revenue from the cohort during the period.

Remember, the Gross Revenue Retention formula is similar to the Gross Dollar Retention formula, and both should exclude upselling or cross-selling from the calculation. The difference lies primarily in the specifics of the cohort chosen and the type of revenue measured.

By calculating GDR, you can gain valuable insights into customer behavior and the success of your customer retention strategies. It is a powerful tool for understanding your customers’ long-term value and assessing your company’s financial health.

The Role of Existing Customers in Dollar Retention

Existing customers play the most important role in maintaining and increasing dollar retention rates in a SaaS business. High gross dollar retention (GDR) rates reflect a company’s ability to retain the revenue generated from its existing customer base over a specific period.

The reason for this is simple: retaining existing customers is more cost-effective than acquiring new ones. Statistics from Harvard Business Research suggest that the cost of acquiring a new customer can be anywhere from five times to twenty-five times more expensive than retaining an existing one. Therefore, investing in customer retention strategies can significantly improve your company’s GDR and overall profitability.

Implementing a customer success program can also prove instrumental in retaining customers. A customer success team ensures that customers derive maximum value from your product or service, thereby increasing customer satisfaction and retention.

Up-selling and cross-selling to existing customers can also increase your revenue, but it is essential to note that these revenues are not factored into GDR. They are part of net dollar retention and contribute to the overall company growth.

Moreover, tracking usage patterns can provide insights into how customers use your product or service. It can highlight features that customers find most valuable, helping to inform your product development and marketing strategies.

While GDR focuses on the revenue retained from existing customers, improving customer satisfaction, investing in customer success, and tracking usage patterns are critical strategies for improving your company’s overall dollar retention.

Expansion Revenue and Gross Dollar Retention

Expansion revenue is an important element in the financial health of SaaS businesses. It refers to additional revenue generated from existing customers through upselling, cross-selling, or price increases. Expansion revenue indicates customer satisfaction and product value, showing customers are willing to spend more on a product or service over time.

While Gross Dollar Retention (GDR) focuses solely on the revenue maintained from the existing customer base without considering upsells or cross-sells, expansion revenue plays a significant role in calculating Net Dollar Retention (NDR). NDR includes both GDR and expansion revenue, providing a more holistic view of a company’s revenue growth and retention.

A high expansion revenue can lead to a higher net dollar retention, even if the GDR is steady. This is because the additional revenue from existing customers offsets any lost revenue from churned customers, leading to overall growth in recurring revenue. A high NDR (over 100%) indicates that a company is growing its revenue even without adding new customers.

SaaS companies can leverage expansion revenue by focusing on customer success and satisfaction. Ensuring that customers derive value from your product increases the chances of upselling and cross-selling. This could include introducing new features, premium packages, or complementary services that customers may find beneficial.

Moreover, companies can offer pricing models that encourage more extensive product or service use. For example, usage-based pricing can incentivize customers to use more features or services, thereby increasing the potential for expansion revenue.

While expansion revenue does not directly impact GDR, it plays a significant role in achieving higher net dollar retention and overall business growth.

Comparing Gross Dollar Retention and Net Dollar Retention

Gross Dollar Retention (GDR) and Net Dollar Retention (NDR) are critical metrics for SaaS businesses, each providing different insights into a company’s financial health and customer behavior. While they both measure revenue retention, they differ in the components of revenue they include.

GDR measures the percentage of recurring revenue retained from existing customers over a specific period, excluding revenue from upsells, cross-sells, and new customers. It provides a pure look at the company’s ability to retain revenue without the impact of expansion revenue. A high GDR signifies strong customer satisfaction and product stickiness, indicating that a company can maintain its revenue levels even without growth from existing customers.

On the other hand, NDR includes both retained revenue and expansion revenue (upsells and cross-sells) from existing customers. A high NDR, especially one over 100%, signifies that a company is retaining its customer base and successfully expanding revenue within that base.

Both are significant for SaaS businesses. GDR can provide insights into product value and customer satisfaction, serving as a warning signal for customer churn. By including expansion revenue, NDR offers a more comprehensive view of a company’s growth potential. Focusing on improving both metrics can lead to more sustainable, customer-centric growth. The balance between GDR and NDR provides valuable insights for companies to understand the dynamics of their revenue stream and plan their customer retention strategies.

Conclusion

Calculating Gross Dollar Retention (GDR) accurately is critical for any SaaS business to understand its financial health and customer satisfaction. It provides insights into the recurring revenue maintained from existing customers, serving as a key indicator of customer loyalty and product value. Equipped with an understanding of GDR, businesses can tailor their customer retention strategies and make data-driven decisions. Additionally, when analyzed alongside other metrics like Net Dollar Retention (NDR), GDR can offer a comprehensive view of a company’s growth potential. Thus, mastering the art of calculating and interpreting GDR is pivotal for the continued success of SaaS companies.

Frequently Asked Questions (FAQs)

What is the gross dollar retention?

Gross Dollar Retention (GDR) is a metric that measures the percentage of recurring revenue retained from existing customers over a specific period, excluding the revenue from upsells, cross-sells, and new customers.

How do you calculate the gross retention rate?

The gross retention rate can be calculated by dividing the Monthly Recurring Revenue (MRR) at the end of a period by the MRR at the beginning of that period, excluding any revenue from new customers, upsells, or cross-sells. The result is then multiplied by 100 to give a percentage.

How do you calculate NRR and GRR?

Net Revenue Retention (NRR) is calculated by taking the MRR at the end of a period, including revenue retained from existing customers plus any expansion revenue, and dividing it by the MRR at the start of that period. Gross Revenue Retention (GRR), similar to GDR, measures the MRR retained from existing customers, excluding expansion revenue. The calculation is (End of Period MRR from existing customers / Start of Period MRR) * 100.

Here are more useful SaaS calculations:

How to Calculate Customer Life Time Value

How to Calculate the SaaS Quick Ratio

How to Calculate Annual Recurring Revenue