How to Calculate Customer Acquisition Costs (CAC)

A SaaS business metric that warrants extra attention and consideration is the Customer Acquisition Cost (CAC). The CAC, by definition, represents the total marketing and sales spend required to acquire a new customer and is a crucial indicator of the efficiency of a company’s sales and marketing efforts.

Where customer acquisition costs are high, like in a SaaS company, calculating and understanding CAC is a foundational skill for any CFO. Accurate CAC SaaS calculation is not only necessary for internal decision-making but also important for potential investors and stakeholders who use it to evaluate the health and potential of the business. In this article, we will delve into the intricacies of CAC, including what it is, how to calculate it, and how to leverage it for strategic decision-making in a SaaS context.

Understanding Customer Acquisition Cost (CAC)

Customer Acquisition Cost for a SaaS company is the total cost to convince a potential customer to purchase a software or service. This total cost refers to the sales and marketing spend, including both personnel and program costs. The Customer Acquisition Cost (CAC) formula is straightforward: Total Marketing and Sales Spend in a given period divided by the number of New Customers acquired in the same period.

CAC Formula:

However, understanding CAC goes beyond just knowing its formula. For example, the CAC reflects a company’s efficiency in converting potential leads into paying customers – a lower CAC implies that the company can acquire customers more efficiently. At the same time, a high CAC may indicate inefficiencies in the company’s sales and marketing efforts, which could cause concern.

The CAC SaaS metric is intrinsically linked with another key SaaS metric: the Customer Lifetime Value (CLV). The balance between these two metrics determines the profitability of a SaaS company in the long run. Therefore, understanding the relationship between CAC and CLV is crucial for SaaS companies’ strategic planning and resource allocation. In the following sections, we will delve deeper into the intricacies of CAC calculation and its applications.

CAC Calculation Examples

Let’s consider two practical examples to understand how to calculate CAC using this customer acquisition cost (CAC) formula CAC = (Total Marketing and Sales Expenses) / (Number of New Customers Acquired):

Example #1

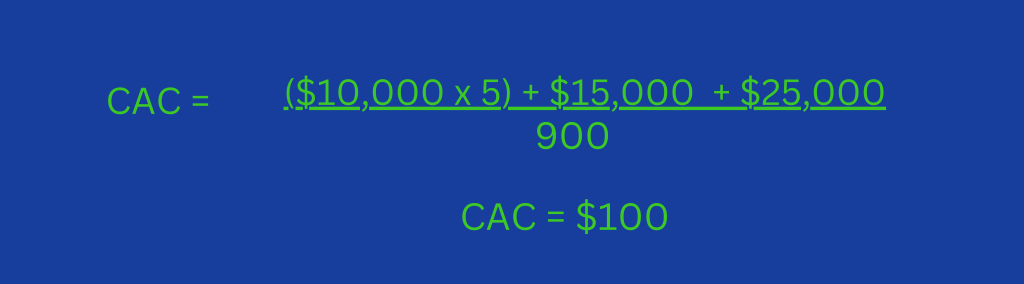

Assume a B2C SaaS company has the following monthly costs: five marketing employees at $10,000 each, $15,000 on external agencies, and $25,000 on various program spends (SEM, trade shows, etc.). The total cost is $80,000. If this results in 800 new customers, the CAC is $100 ($80,000 total cost / 800 new customers).

Example # 1 Calculation:

Example #2

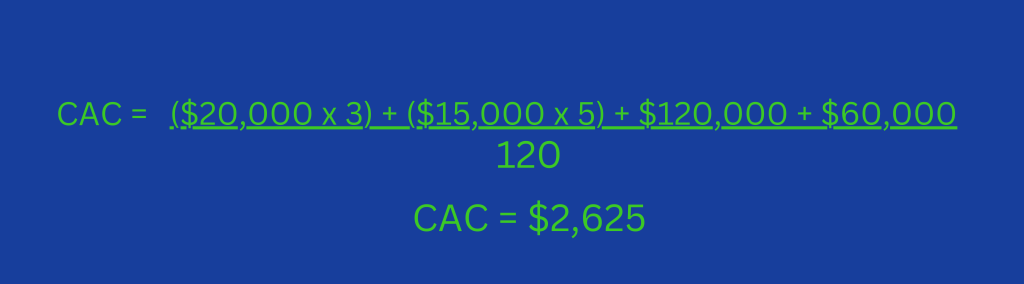

A B2B SaaS company incurs the following quarterly costs: three marketing employees with a salary of $20,000 each; five sales employees with a salary of $15,000 each; $120,000 in sales commissions; and $60,000 in consulting fees for an external marketing agency – totaling $315,000. If the company acquires 120 new customers during this quarter, the CAC is $2,625 ($315,000 total cost / 120 new customers).

Example #2 Calculation:

The two examples above emphasize the importance of factoring in all relevant costs and the need to understand CAC concerning the number of new customers acquired.

Strategic and Operational Considerations in Calculating CAC

Beyond the simple arithmetic of dividing marketing and sales expenditure by the number of new customers, SaaS companies need to understand the strategic and operational factors influencing their CAC. By considering these factors, companies can gain a more nuanced understanding of their CAC, enabling them to refine their strategies and optimize resources. Here are some key considerations:

- CAC and Business Stage: Early-stage companies might have higher CAC as they invest heavily in marketing and sales to establish their market presence. In comparison, mature companies may have lower CAC due to established brand recognition and customer referrals.

- CAC and Business Model: A freemium model might have a higher CAC due to the need to convert free users to paying customers, whereas a direct sales model may have a lower CAC due to higher initial customer commitment.

- CAC and Target Market: A niche market might require more specialized and costly marketing strategies, resulting in a higher CAC, for example, while a mass market might allow for a broader and more cost-effective strategy.

- CAC and Competitive Environment: In a highly competitive market, companies might need to invest more in marketing and sales to differentiate themselves, leading to higher CAC.

- CAC and Product Complexity: More complex products might require more education and persuasion to convince customers to buy, resulting in a higher CAC.

- CAC and Seasonality: Some businesses might see fluctuating CAC throughout the year due to seasonal changes in consumer behavior.

- CAC and Marketing Channels: Different marketing channels can have different CACs. For instance, the organic search might have a lower CAC than paid advertising, and calculating CAC for each channel separately is advised to optimize marketing spend.

The Relationship Between CAC, LTV, and Retention Rates

Understanding the relationship between Customer Acquisition Cost (CAC), Customer Lifetime Value (LTV), and customer retention rates can provide SaaS companies with vital insights into their business performance and financial health. In addition, these relationships are essential when calculating and interpreting CAC and can significantly influence a SaaS company’s strategy and decision-making.

- CAC and LTV: A higher LTV than CAC signifies that the value derived from customers over their lifetime is greater than the cost to acquire them, indicating a profitable business model.

- LTV and Retention Rates: Higher retention rates can increase LTV as customers continue to generate revenue for longer.

- Balancing CAC, LTV, and Retention Rates: Companies must manage these three metrics effectively to ensure sustainable growth and profitability.

Leveraging CAC as a Business Metric

CAC is a critical metric that can provide valuable insights into a SaaS company’s financial health and the efficiency of its sales and marketing strategies. Here are some examples of how it can be leveraged:

- Benchmarking Performance: CAC can be used to benchmark the company’s performance against industry standards or competitors. This can highlight areas of improvement or areas of competitive advantage.

- Identifying Profitable Channels and Segments: By calculating CAC for different customer acquisition channels or customer segments, companies can identify which are more profitable and adjust their marketing and sales strategies accordingly.

- CAC and Customer Lifetime Value (CLV): Comparing CAC with CLV can indicate the return on investment for each customer and inform decisions about customer retention and acquisition strategies.

Common Mistakes in Calculating and Using CAC

While the calculation of Customer Acquisition Cost (CAC) might seem straightforward, there are common pitfalls that SaaS companies may often encounter. Understanding these potential mistakes can help SaaS businesses avoid them and ensure their CAC calculations are accurate and reliable. Below are some of the common mistakes that may occur when calculating CAC:

- Excluding Certain Costs: One of the most common CAC mistakes is not accounting for all the costs involved in customer acquisition. This includes direct marketing expenses, such as advertising spend, sales and marketing staff salaries, and marketing software costs. Leaving out any of these costs can lead to an artificially low CAC, which can mislead decision-making.

- Not Differentiating Between Customer Types: Another mistake is not differentiating between various types of customers when calculating CAC. Customers from different segments, markets, or product lines can have vastly different acquisition costs. Calculating a single, company-wide CAC can often conceal these variations and lead to skewed interpretations.

- Ignoring the Time Factor: Many companies overlook the importance of the time factor in customer acquisition. As a result, they fail to account for the time lag between the investment in marketing and sales efforts and when a lead converts into a paying customer. This can result in overestimating CAC in the early stages of these initiatives and underestimating it in later stages.

- Monitor CAC Over Time: CAC should not be seen as a static metric. It can and will change over time as the company evolves, market conditions change, and marketing strategies are refined. Therefore, tracking CAC over time and analyzing trends is critical to glean actionable insights for strategic decision-making.

- Confusing CAC with Cost Per Lead (CPL): Some businesses may confuse CAC with CPL, significantly distorting their understanding of customer acquisition efficiency. While CPL is the cost of acquiring a lead, CAC involves converting that lead into a paying customer – an important distinction to remember.

- CAC in Relation to Customer Lifetime Value (CLV): Lastly, it’s important to analyze CAC in conjunction with CLV. Suppose the cost of acquiring a new customer (CAC) is higher than the revenue the customer will generate over their lifetime (CLV). In that case, there is likely a problem with the business model. Maintaining a healthy ratio between CAC and CLV for long-term profitability is the only way to long-term success.

Conclusion

Understanding and accurately calculating the Customer Acquisition Cost (CAC) is a cornerstone of financial insight for any SaaS company. A SaaS business’s CAC is not just a number but a fundamental business metric that, when used properly, can contribute significantly to the company’s growth and ultimate success. Specifically, it provides a valuable measure of the efficiency of a company’s marketing and sales strategies and can guide tactical and strategic decisions.

Frequently Asked Questions (FAQs)

- What is a good CAC for SaaS?

There isn’t a one-size-fits-all answer to this question, as the ‘good’ CAC can vary based on factors like the industry, business model, and target market. However, a general rule of thumb in the SaaS industry is that the CAC should be one-third of the Customer Lifetime Value (CLV).

- How do you calculate CAC for SaaS?

CAC is calculated by dividing the total marketing and sales expenses in a given period by the number of new customers acquired in that same period.

- What is ideal CAC to LTV ratio for SaaS?

In financial accounting for SaaS, an ideal CAC to LTV ratio is often considered to be 1:3. This means that the value of a customer over their lifetime should be three times the cost of acquiring them. If the ratio is less than this, it may indicate that the company is spending too much on customer acquisition.

- What is the average LTV to CAC ratio for SaaS?

While the ideal LTV to CAC ratio is 3:1, the average can vary significantly based on factors like the company’s size, growth stage, and the specific SaaS sector. Benchmarking against companies in the same sector and growth stage is best for the most accurate comparison, and regional differences can also be an important factor to consider.

For more on customer acquisition, costs, and value, here are three more blog posts to explore: